Acquisition of Shares in Esso (Thailand)

This Executive Talk was honored by

Mr. Chaiwat Kovavisarach

Bangchak Group Chief Executive Officer and President

This Executive Talk was honored by Mr. Chaiwat Kovavisarach, Group Chief Executive Officer and President to share us about the ESSO acquisition deal which has just been announced via The Stock Exchange of Thailand on January 12, 2023.

- This investment is an important step for Bangchak Group. Mr. Chaiwat, what do you see from this key national deal?

-

I believe this investment brings 3 good points:

- Good for the country as this is to acquire strategic assets in the energy sector which would strengthen the national energy security. Previously, 65.99% of the shares were owned by foreigners, but it will belong to Thai people from now on so that Thailand would become more self-reliant.

- Good for consumers as they will be able to access energy with more affordable price and more various products and services of Bangchak.

- Good for Bangchak as we will become stronger with the highest refining capacity in Thailand (the total refining capacity is almost 300,000 barrels per day) while our service stations will be about 2,100 stations.

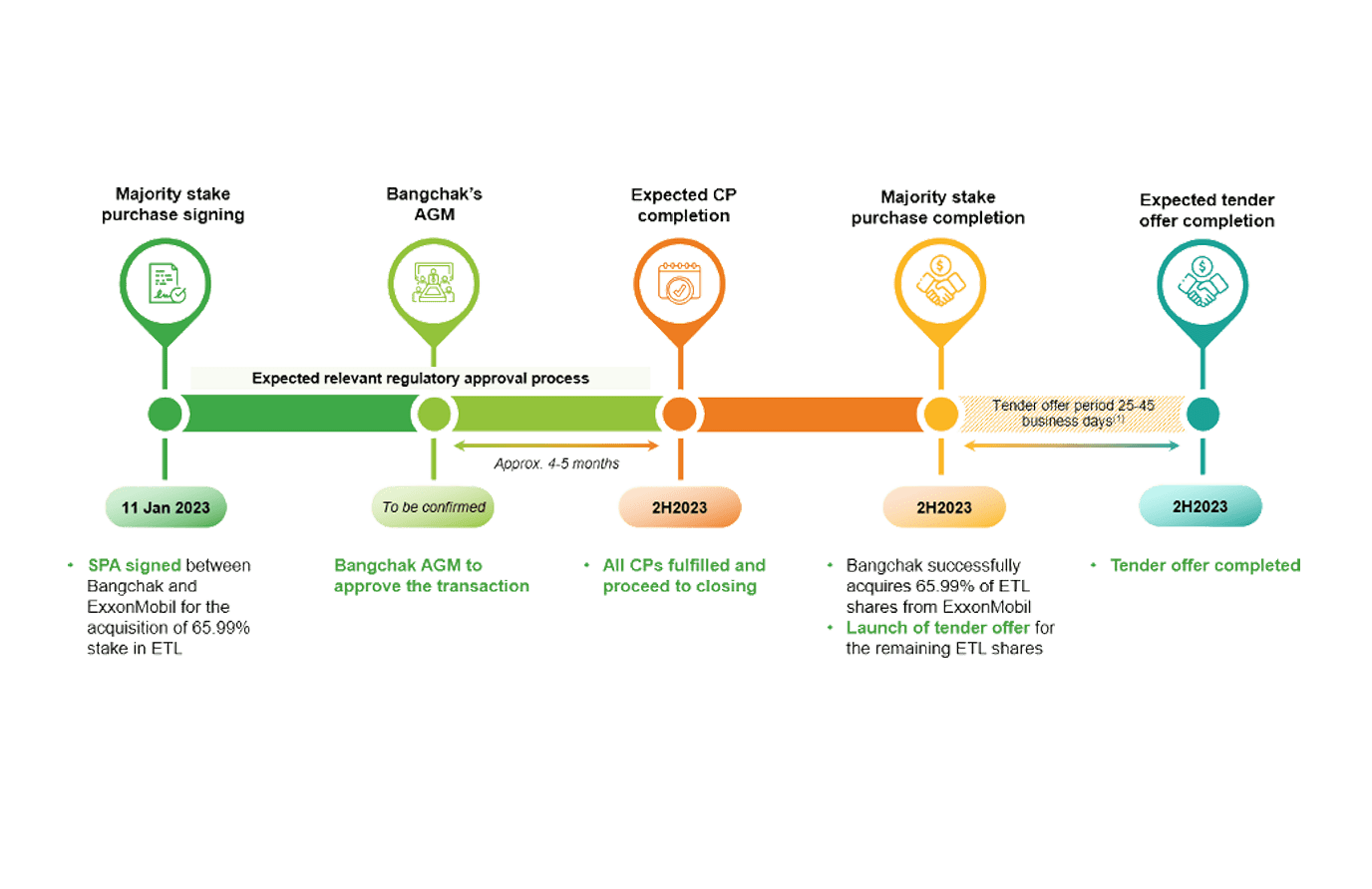

- What would be the time frame and next steps?

- Bangchak entered into the share purchase agreement to acquire 65.99% of shares in Esso (Thailand) Public Company Limited ("ESSO”) from ExxonMobil Asia Holdings Pte. Ltd. on 11 January 2023. The share purchase will take place once all conditions are completed. Also, after the completion of transactions, Bangchak will subsequently launch a tender offer for the remaining shares of ESSO (approximately 34.01%), which is expected to be completed in the second half of 2023.

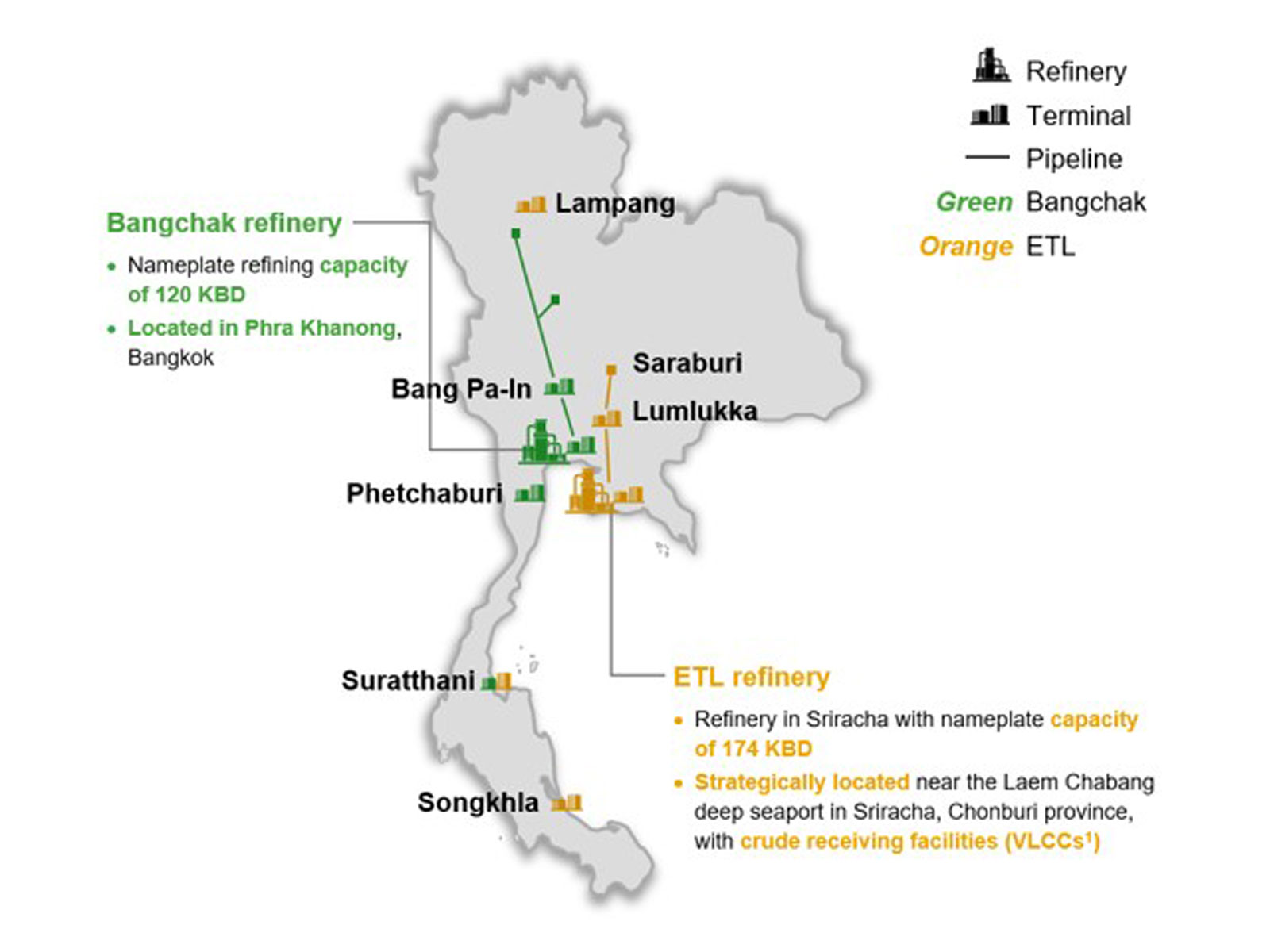

- This business acquisition offers several synergies to both Bangchak and ESSO refineries.

-

- Increased total nameplate capacity as Bangchak will own and operate another refinery located in the area where is easily accessible to crucial crude oil receiving facilities, and suitable for very large oil tankers (very large crude carrier (VLCC)). It will lead to joint sourcing and transportation.

- Different refining technologies that could refine the complimentary products to each other; therefore, both refineries will be more flexible in supply, production, and capability to produce more high-value specialty products. This will eventually reflect in the increase in gross refinery margin (GRM) for both.

- Decreased logistics cost from the benefits of joint infrastructure and pipeline systems with ESSO from owing oil terminals and a shared terminal with Thai Oil PLC as well as 2 terminals in Lampang and Sriracha. Bangchak will be the only one being able to access 2 pipeline networks.

In addition, the upcoming synergy includes a reduction in back-office expenses from the economies of scale of Bangchak Group that would grow, and such synergy would help decrease cost of approximately 1.5 - 2.0 billion Baht.

- The indicative purchase price per share at 8.84 Baht, how it comes?

-

The indicative price was calculated based on 55.5 billion Baht Enterprise Value. The calculation was made under Discounted Cash Flow approach regarding the financial statement of June 2022. The indicative price will be adjusted according to the latest reviewed financial statement before the closing of the transaction to reflect the change in net debt, working capital, inventory, and other financial assets, including adjustments for inventory related to finished lubricant and chemical marketing businesses.

For example, by referencing ESSO’s reviewed financial statements as of 30 June 2022 and 30 September 2022, the total purchasing value would be around 20,198 - 21,982 million Baht or 8.84 - 9.63 Baht per share. The final price may increase or decrease to reflect the actual numbers at the completion date of the Transaction based on the aforementioned mechanism.

Balance Sheet (THB million) For illustration only Date 30 Jun 2022 30 Sep 2022 Enterprise value 55,500 55,500 (-) Net debt and debt equivalent items (25,584) (41,637) (+) Other financial items 2,838 2,914 (+) Select working capital adjustments 2 13,178 (+) Financial Statement Date working capital (8,902) 1,399 (+) Reference Working Capital 9,457 9,457 (-) Volume and price linked hydrocarbon inventories adjustments (554) 2,322 (+) Other adjustments in accordance with the Share Purchase Agreement 557 654 = Equity value 33,312 30,608 / Number of the ESSO’s shares (million shares) 3,461 3,461 = Purchase price per share (THB/share) 9.63 8.84 x Number of Sale Shares (million shares) 2,284 2,284 = Total value of the Sale Shares 21,982 20,198 - How Bangchak will fund this acquisition?

-

The acquisition will be mainly funded by bank loans which would be sufficient for completing the transaction and tender offer of the remaining shares, including refinancing ESSO’s loans with third parties as well as related parties.

However, Bangchak might as well consider utilizing cash and cash equivalents to partially support this acquisition. As of 30 September 2022, Bangchak’s cash and cash equivalents was 33,288 million Baht.

- Lastly, Mr. Chaiwat, what would you like to say to investors?

-

Bangchak will still continue to focus on the balance of 3 energy challenges. I see this investment as the balance of 3 energy challenges.

Energy Security

- Refineries that are crucial to the country's energy security will be ours.

- High-capacity oil terminals with a production capacity of up to 15 million barrels, leading to an increasing in fuel reserves and energy security.

The Energy at the affordable price

- The extensive fuel transportation network will help supply fuel to consumers with competitive prices.

- Benefits from a lower cost structure would also help offer products to consumers at affordable prices.

Environmental Sustainability

- Be able to maintain high environmental standards and correspond energy transitions by utilizing excess cash flows.

This investment is a part of Bangchak's long-term strategic plan, which is another significant chapter for Bangchak to have another family member, Esso Thailand, who has a long experience in this business. The Bangchak family will be bigger, stronger, and become a sustainable company for another 100 years.

More information on this acquisition and webcast elaborating the deal was posted on https://investor.bangchak.co.th/en/document/presentations

Mr. Chaiwat Kovavisarach

Bangchak Group Chief Executive Officer and President