Bangchak Reflects Success Across All Business Groups, Propelling Towards a Robust 40th Year

This Executive Talk was honored by

Ms. Phatpuree Chinkulkitnivat

Senior Executive Vice President, Accounting and Finance

Ms. Phatpuree Chinkulkitnivat, Chief Financial Officer and Senior Executive Vice President, Accounting and Finance was interviewed by Money Talk, an economic, finance, and capital market focused online program, on December 28, 2023.

This Executive Talk brought to you some parts of the interview that Ms. Phatpuree or Khun Toey, our CFO, shared about Bangchak’s robust growth in the recent year and how Bangchak is poised to facilitate growth into its 40th year in 2024.

- Bangchak grew substantially for the past 3-4 years, could you please share some strategic changes that happened during the period?

-

As you may know, Energy Transition has been with us for a while. Bangchak’s business started with a refinery and service station, however since 2019 we diversified our business portfolio into other businesses, including Clean Power business, Bio-Based business, and E&P business (Natural Resources). We sought potential partners to coordinately operate and develop growth in our business. Even during the COVID-19 pandemic, we added new resources. Our E&P business through OKEA in Norway was able to double its production capacity year over year for the past 2-3 years.

Also, the acquisition of shares in Bangchak Sriracha (BSRC) (formerly Esso (Thailand)) last year, results in an increasing production capacity of our refinery from 120 KBD to almost 300 KBD. Together with the network of service stations acquired from BSRC, we currently have more than 2,000 service stations nationwide.

- As one of the leaders in energy transition, please give us some examples of projects in pipeline for this year?

-

Apart from the investment in the Clean Power business through our subsidiary BCPG, we plan to install more infrastructure to support the growing EV demand. There are currently over 200 service stations with EV chargers.

There are several businesses that could not shift to battery usage, especially industries with high carbon emissions e.g. the aviation industry. That’s why Bangchak allocated THB 10 billion to invest in the SAF (Sustainable Aviation Fuel) project (aviation fuel produced from used cooking oil). Bangchak’s SAF project is the first and only SAF production unit in Thailand and the second in Asia Pacific. Moreover, the European Commission has proposed a SAF blending mandate for fuel supplied to EU airports, with minimum adding portion of SAF gradually increasing from 2% in 2025 to 70% in 2050. Thus, our SAF unit is one of the projects towards energy transition, which we believe does not have to be in the form of electricity only.

- What does Bangchak do to manage business volatilities influenced by external factors such as economic, exchange rate, and geopolitical factors?

-

To mitigate impacts from oil prices and refining margin fluctuations, Bangchak always places importance on maintaining its strong financial position. After the acquisition of share in Esso (Thailand), the historic deal amounting to THB 26,000 million which we mostly use our cash on hand, only THB 8,000 million required for debt-financing. We closely monitor the debt ratio to avoid getting into unnecessary debt. Consequently, Bangchak’s Net Debt to Equity Ratio (Net D/E) remains healthy at a level not exceeding 1 time while Net Debt to EBITDA was at around 2 times. As we have prepared our financial position and conducted sensitivity analysis to determine whether we could further expand our business under volatile economic conditions. Besides, we revisit our investments from time to time and decide to exit or divest the investment to recycle our cash into other businesses that will give us a better return. This is a strategy that we continuously implement to manage our investment that gives us headroom for further investment in the future.

- Bangchak target EBITDA to grow from THB 40 billion to THB 100 billion in 2030. As CFO, could you please give us some ideas on how each business would support this growth?

-

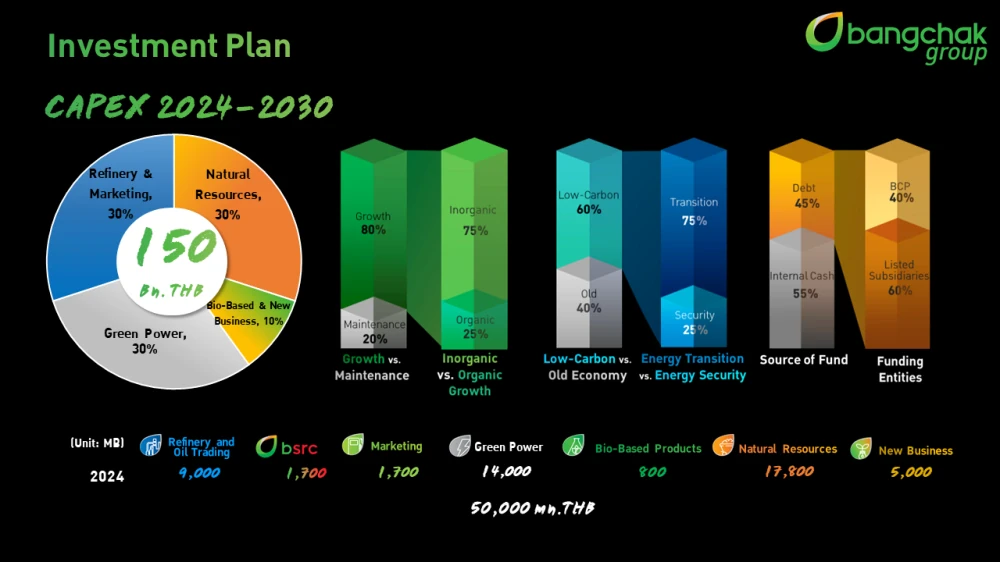

Our investment plan for 2024-2030 is divided into 3 groups, of which 30% will be for Refinery and Marketing business. For one year after acquiring BSRC, we will focus on creating synergy with BSRC, 1+1 to be greater than 2. We aim for the synergy realization of THB 3 billion at EBITDA level.

The next 30% CAPEX will be for Natural Resources business which our growth engine will be OKEA business in Norway. We also seek M&A opportunity to further expand E&P business in the Asia Pacific area.

The last 30% CAPEX will be allocated to Green Power business to support the energy transition.

EBITDA growth will come from the combination of Organic and Inorganic growth. For organic growth, as mentioned earlier, there will be synergy that we are going to build after acquiring BSRC as well as SAF project which we have competitive advantage from being the first mover and high demand from airlines. Inorganic growth will be from new investment and M&A. There will be new investment added to BCPG’s portfolio. Also, OKEA as well as Bangchak are seeking the M&A opportunity to further expand the E&P business.

Please follow the link below to watch the interview presented by MoneyTalk:

Facebook - MoneyTalkTV : https://fb.watch/pcwFAgzOfr/

YouTube - MoneyTalkChannel : https://youtu.be/VMwqXYnLOSs

Ms. Phatpuree Chinkulkitnivat

Senior Executive Vice President, Accounting and Finance