Oil Market Outlook

Dubai AVG

QoQ

Unit: $/BBL

YoY

Unit: $/BBL

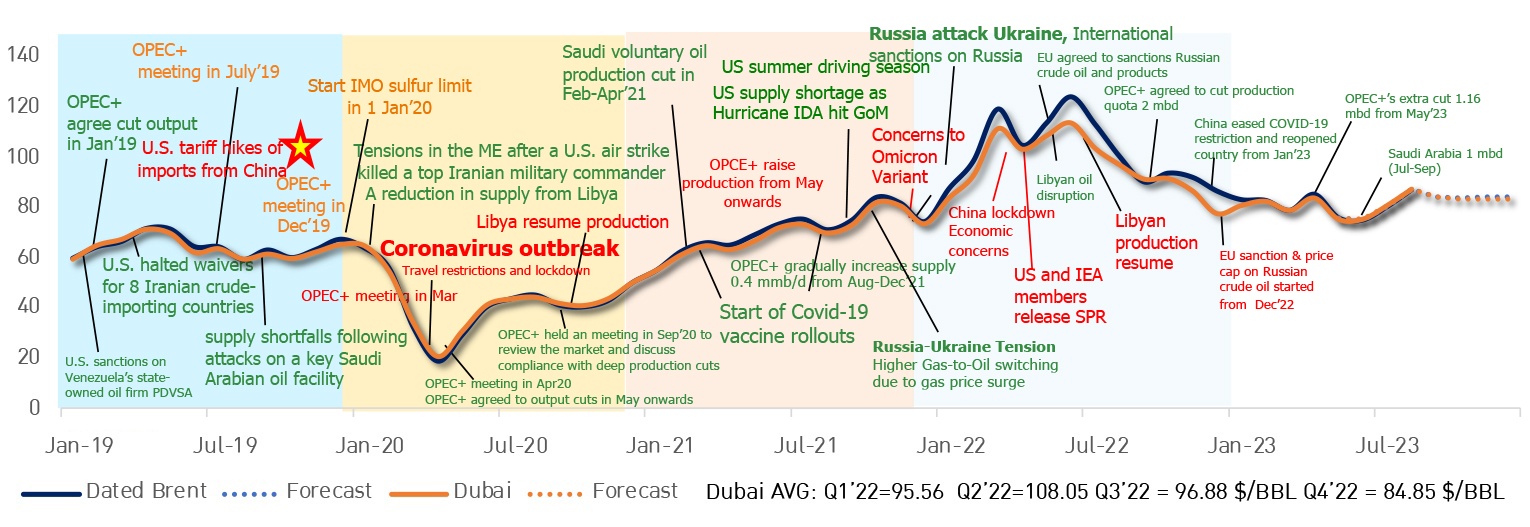

Crude price move around 80-85 $/BBL in H2’23, Crude oil price will be supported by OPEC+ cut policy including Saudi Arabia’s voluntary cut 1 mbd during Jul-Sep to stabilize oil market and Fed rate hike cycle will be ended soon. While China gradually launches stimulus measures to recover economic activities. However, the market will be pressured by concerns on economic slowdown.

Focus on H2’23:

- Concern on economic slowdown in key markets as their central banks have raised interest rate to curb with inflation that have negative impact on oil demand

- OPEC+ extended production cut policy from May 2023 until end of year to stabilize oil market

- Saudi Arabia voluntary cut 1 mbd during Jul - Sep 2023

- Oil demand during summer driving season and winter season

- China’s stimulus measures to recover economic activities

Market Highlights in 2023:

- Economic slowdown in key countries

- Chinese’s economic recovery

- OPEC+ policy to control production to stabilize oil market

- Global geopolitical issues need to be closely monitored

Dated Brent - DB Spread H2’23

- OPEC+ and Saudi Arabia production cut policy in second half of year to stabilize market (Stronger DB)

- H2’23 spread is likely to remains narrow due to Europe’s weak economy pressuring on oil demand and high supply in the region especially from US (Weaker Dated Brent)

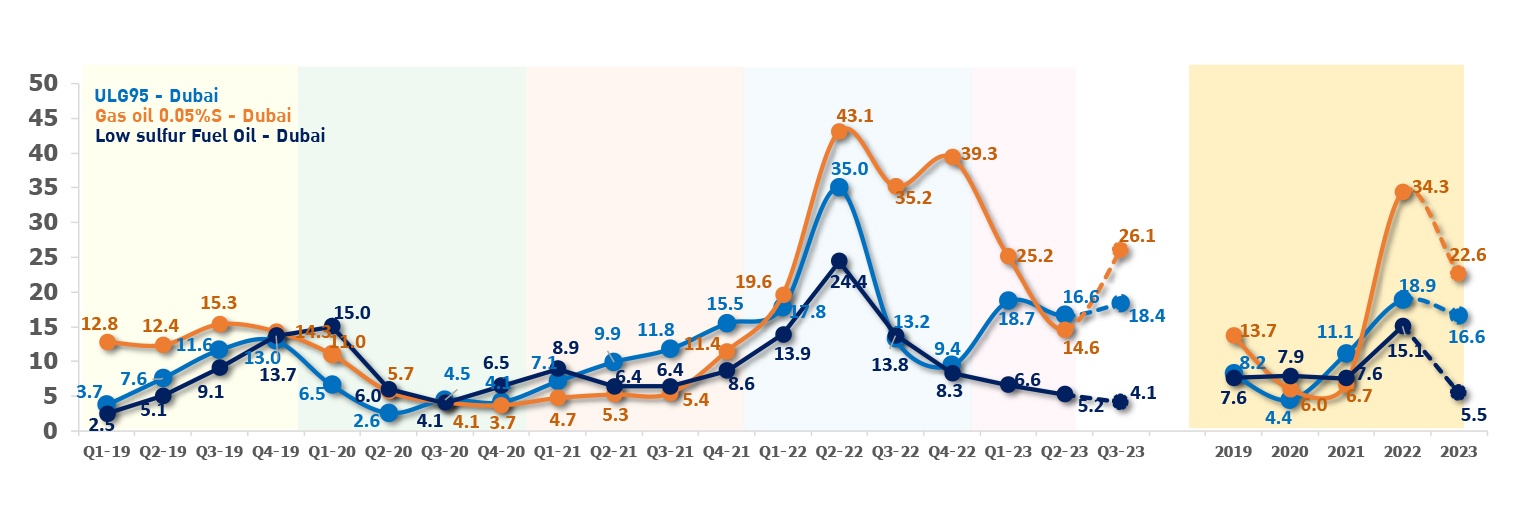

Weaker gasoil crack as supply concerns eased from high refinery run rates and more exports amid concern over economic recession weighed on demand. However, China’s demand recovery will limit the downside. Soften gasoline crack as higher exports amid the inflation concerns could cap the upside demand, but expected steady demand will remain support fundamental. Lower Low Sulfur Fuel Oil crack due to higher supply from Kuwait’s Al Zour refinery export.

Focus on 2H’23:

- Gasoline crack will be steady amid healthy driving demand during summer in the U.S. and the year-end holiday travel season with the continued demand recovery to pre-COVID. However, the refineries could exports further after return from maintenance and keep high runs

- Gasoil crack will be supported by lower supply as reduced availability of sour crude from Saudi Arabia’s production cuts amid low stocks level, but expected refineries keep high runs and maximize gasoil production while demand subdued as soften global economic activities will weigh on crack

- Low Sulfur Fuel oil crack will be slightly stronger from bunkering demand and heating demand during fourth quarter. However, abundant supply from Kuwait’s Al Zour refinery is pressuring the market

Market Highlights in 2023:

- Concern over looming interest rate hikes and recession dampening growth and fuel demand, especially in the U.S. and Europe

- Europe sanction Russian oil imports will be limited impact due to softer-than-expected lead to ease supply concerns amid weakened European demand

- Kuwait Al Zour refinery has been completed, likely to adding more Low Sulfur Fuel Oil supply to market

- China’s restrictions easing and stimulus package could support demand growth

- Expected demand recovery to pre-COVID levels as eased restrictions and further border reopening with the more recovery of Jet demand in China